Why Choose XM Broker #

Trade with XM Broker if:

Reliable Trading Platform #

Platform reliability is of utmost importance to you. The broker has been in the market for many years, operating in 190 countries, and is multi-regulated.

Educational Resources #

You are willing to learn while trading. XM Group is one of the few brokers that not only provides basic educational materials on its website but also regularly conducts webinars and even offline meetings in 120 cities worldwide.

Do not trade with this broker if:

Account Types Offered by XM Broker #

XM offers various account types to cater to the diverse needs of traders.

Micro Account #

This is a cent micro lot account type. 1 lot is 1,000 units of basic currency. Minimum trade volume is 0.1 lot. Spread is from 1 pip.

Standard Account #

This is a standard account type. 1 lot is 100,000 units of basic currency. Minimum trade volume is 0.01 lot. Spread is from 1 pip.

XM Ultra Low Account #

1 lot is 1,000/100,000 units of basic currency. Minimum trade volume is 0.1/0.01 lots. Spread is from 0.6 pips. No swaps.

You can get acquainted with the potential of XM Broker by opening a demo account.

How to Open an Account with XM Broker #

To begin trading with XM Broker, you can open either a real or demo account by clicking on the respective buttons on the broker's main page. The demo account comes with an initial deposit of 100,000 US dollars, granting access solely to the platform upon opening. However, registration of a real account is necessary to access your Personal Account.

Steps to Open an Account #

- Fill out the registration form with your name, surname, country/city, phone, and email. Ensure that all data is entered in Latin letters and specify the platform and type of account.

- Your account number, serving as your login, will be sent to the provided email address. You'll need to download the platform from the broker's website and link this account to it. Once you've received the account details, proceed to access your Personal Account. Keep in mind that the registration process takes approximately 10 minutes and only grants access to explore the functionality of the Personal Account. Further registration and subsequent trading require verification.

Account Verification with XM Broker #

XM offers fast account verifications in less than 24 hours. Traders are required to upload actual photos of official identification (both sides if needed) such as a driver's license, passport, or national ID. Proof of residence is required for applicants residing outside their country where their document was issued.

Personal Account Features #

Within the Personal Account, you'll find the following options:

- Deposit and withdrawal of funds (the deposit and withdrawal wallet for mobile money will activate once a deposit is made).

- Correction of personal account details. Under the Account menu, you can adjust the leverage, review transaction history (including ongoing position monitoring), and access the history of replenishments and transactions.

- Changing the password and enabling two-step authentication.

- Requesting the use of a VPS server (available only after verification).

- Accessing trading signals, customer service, and the Invite a Friend program.

Available Instruments for Trading with XM Broker #

- Forex (Currency Pairs)

- Commodities

- Turbo stocks

- Stocks CFDs

- Equity Indices

- Cryptocurrencies

- Energies

- Precious Metals

Leverage Options with XM Broker #

XM offers leverage of up to 1:1000. However, leverage levels can vary depending on the financial instrument being traded and your location. The regulatory requirements in your region may adjust leverage options to comply with local regulations.

Customer Support at XM Broker #

Traders have multiple avenues to connect with XM's support team, including email with CRMs, quick real-time 24/7 live chat, and social media updates and query responses. The support is available in multiple languages depending on the region. Within XM's client portal, a dedicated support section offers information and resources, providing a platform for clients to submit requests or inquiries.

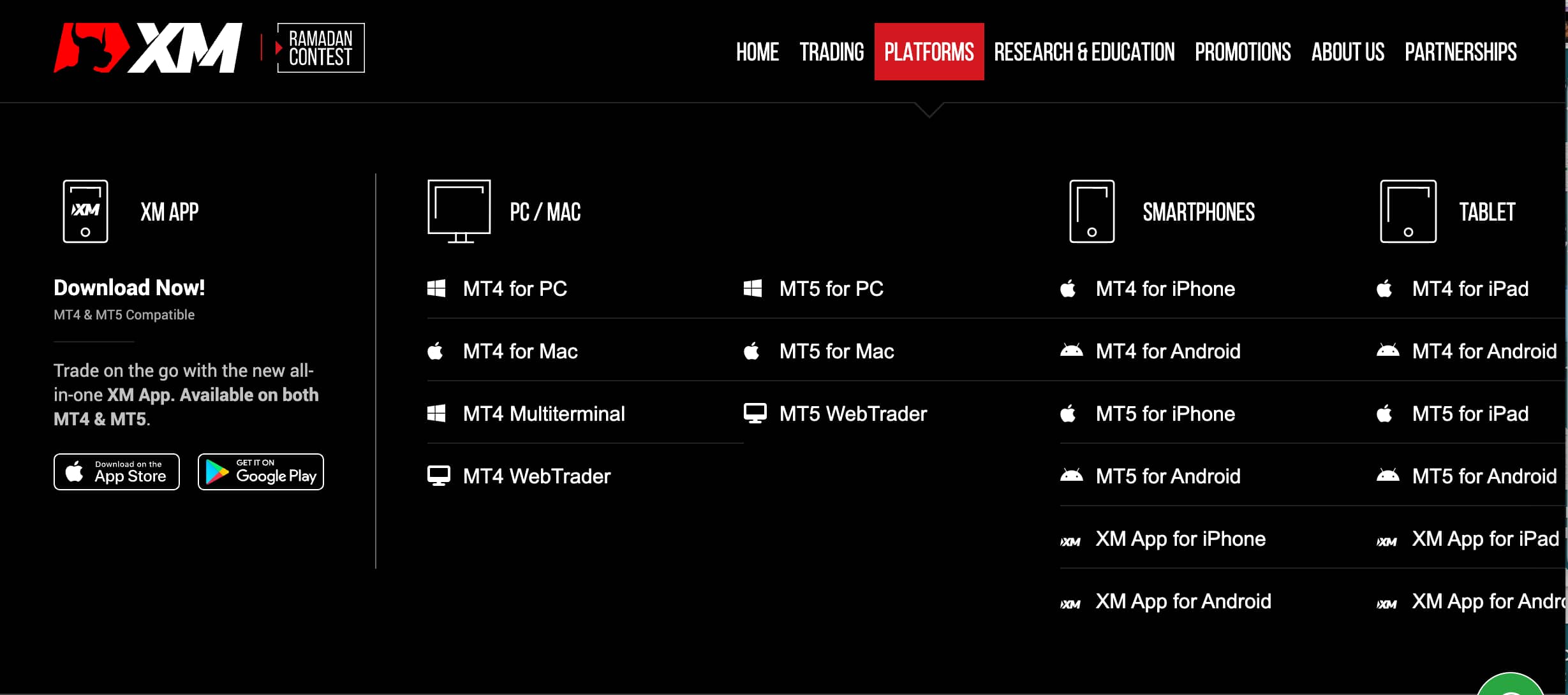

XM Broker Trading Platforms #

XM's trading platforms offer a diverse and comprehensive range, including web and desktop versions of MT4 and MT5 for both Mac and PC.

Traders can access the full array of instruments, excluding share CFDs exclusive to MT5, while enjoying consistent charts and trading order types across all platforms.

Notably, XM's mobile trading allows for direct trading and seamless integration with MT4 and MT5 accounts, providing convenience and flexibility for traders on the go. In summary, XM provides a versatile and accessible trading environment across various devices.

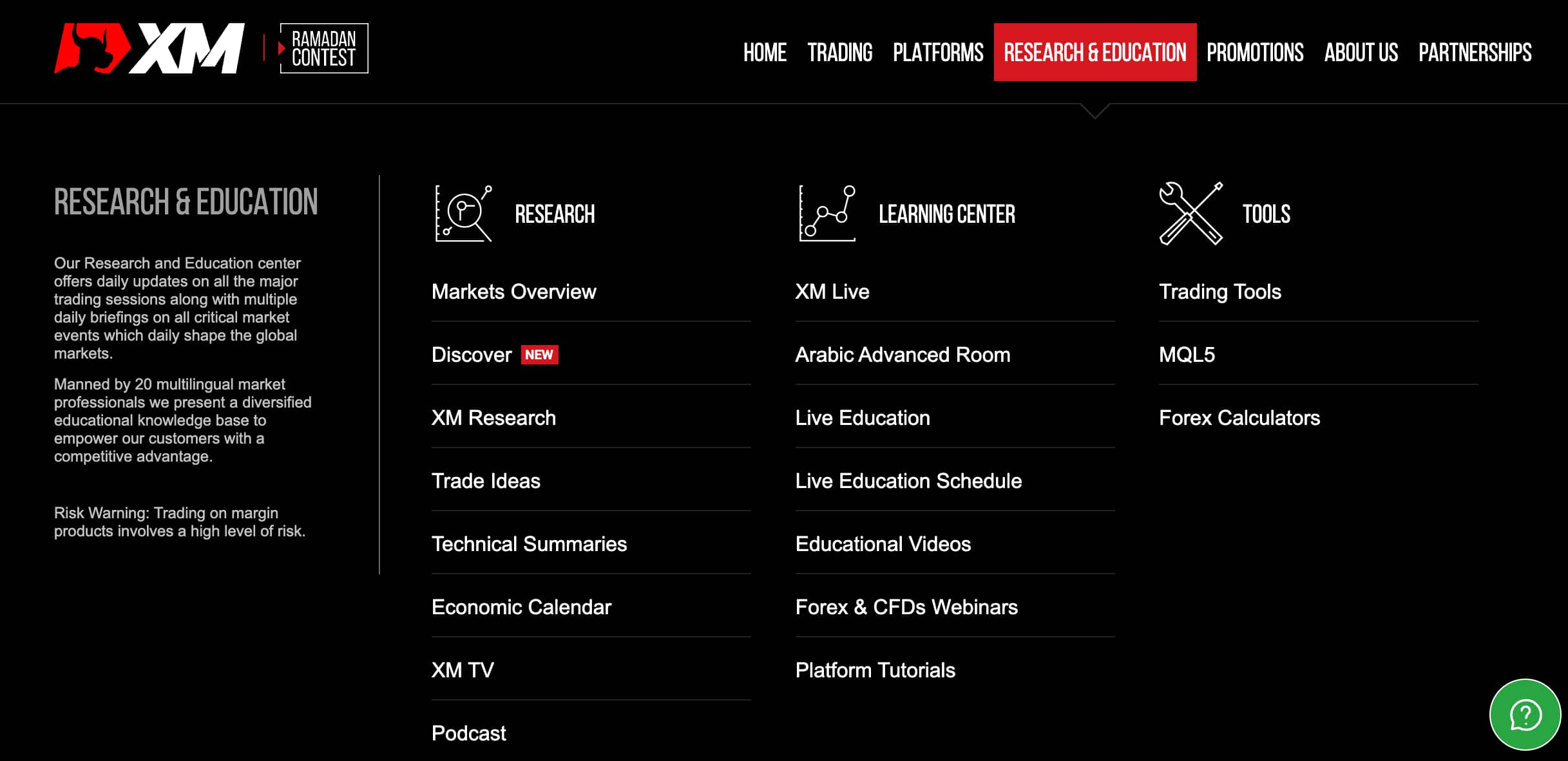

Educational Resources Provided by XM Broker #

XM offers live webinars, Q&A with experts, and live debates for beginner and advanced levels. Traders can access the schedule at the following link: XM Educational Resources.

Deposit and Withdrawal Options with XM Broker #

The account funding process is open 24 hours a day and is fully automated.

- Mobile Money: XM offers multiple deposit and withdrawal options including mobile money (e.g., Mpesa, Airtel, MTN) for East African clients.

- Bank Transfer: Deposits and withdrawals are free; however, withdrawals under 200 USD incur a cost of 15 USD. Deposits and withdrawals take a few days to be processed.

- Credit Card/Debit Card: Deposits are instant and free, but withdrawals, while free, take up to two business days to be processed.

- eWallets (Skrill, Neteller, WebMoney, Perfect Money): Deposits and withdrawals are instant and free. Once your account has been verified by customer service, you can deposit funds through the client portal.

The time for processing a request is 24 hours, and withdrawal time is in accordance with the technical capabilities of payment systems (up to 5 business days). The number of requests is unlimited. The withdrawal currency corresponds to the deposit currency; in case of a discrepancy, the broker automatically converts it at the average exchange rate.

XM Broker Verdict #

XM Trading is a brokerage firm that specializes in low-cost forex and CFD trading, offering a wide selection of over 1000 instruments including forex, precious metals, energy, and indices.

The company is regulated by two top-tier regulators, namely CySEC and ASIC, ensuring a certain level of security for traders. However, it's worth noting that XM Trading is not regulated by the CMA in Kenya, which may pose a slightly higher risk compared to other brokers on the market.

In terms of fees, XM Trading offers competitive rates, primarily through their Ultra Low account option, which features standard spread-only trading without additional commissions. The minimum deposit requirement varies depending on the account type, with the Standard and Micro accounts starting at $5 USD and the Ultra Low account at $50 USD. There's also a Share account tailored for equity trading, requiring a higher minimum deposit of $10,000 USD.

While XM Trading's spreads may be higher compared to some other brokers, particularly with the Micro account where spreads typically range from 1.8 to 2 pips for EUR/USD during normal market conditions, the Ultra Low account offers a more competitive spread of around 0.8 pips.

For those considering opening an account with XM Trading, opting for the Ultra Low account is recommended to maximize returns, as the fees with other account types may not be as competitive.

Customer support at XM Trading is highly regarded, available 24/5 during market trading hours. Additionally, they provide free access to a range of educational resources including research materials, forex webinars, video tutorials, and daily technical analysis. Another convenient feature is their acceptance of M-Pesa for account funding, catering to the needs of Kenyan traders.